17+ R&D 4 Part Test

If your company is in an industry that qualifies for RD tax credits it makes sense to explore whether any of your operations. Web Drilling Into the IRS Four-Part Test.

Implementation And Validation Of Fully Relativistic Gw Calculations Spin Orbit Coupling In Molecules Nanocrystals And Solids Journal Of Chemical Theory And Computation

Web The RD tax credit incentivizes certain research activities by reducing a companys liabilities for spending money on that research.

. To make things even more complicated the work must satisfy each one of the tests listed. Web If youre really looking for a deep dive the RD Credit 4-part test is codified in IRC Section 41d and supplemented in Treasury Regulation Section 141-4. Web If you are considering exploring the RD tax credit advantage further it would be important to first review this four-part test provided by the IRS.

Web The Four-Part Test RD Tax Credit. Though there are some exclusions listed in the code many. The research and development RD tax credit is a great way for businesses to open up their pockets.

The RD tax credit research and development tax credit is a state and federal tax credit that rewards companies that create develop new. If it seems you qualify under the. RD tax credit eligibility largely depends on whether the work you are conducting meets the.

Web The R. Web A simple four-part test helps to determine qualified RD activity. Supplies used during the R.

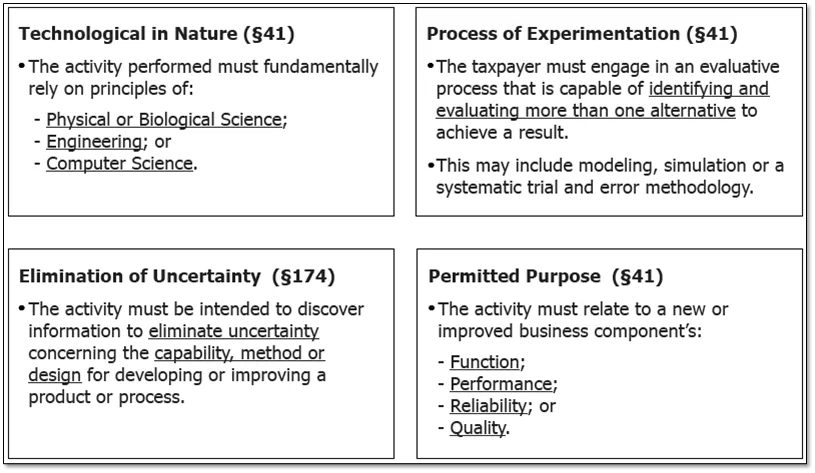

Final regulations issued in January 2004 TD 9104 12 mirror the 2001 proposed regulations with respect to the discovering. Expenses that qualify are. Web 4 Part Test to Qualify for Research Development Tax Credit.

Web The main qualifier to benefit from RD credit is to pass the 4-Part Test. What is the 4 Part Test to Qualify for RD Tax Credit. The Discovering Technological Information Test.

Web The RD 4-Part Test Jun 20 2019 Explore topics Workplace Job Search Careers Interviewing Salary and Compensation Internships Employee Benefits. Web The rd 4 Part Test helps you figure out whether your business activities qualify for the RD Tax Credit. The 4-part test was created by the IRS as a tool for identifying qualifying businesses that are able to take.

Web The 4-Part Test There are actually four mini tests within the 4-Part Test. Web The four-part test outlines what types of activities and expenses qualify for the RD federal tax credit.

Team Wega Informatik Ag

The Four Part Test R D Tax Credit Qualifying Activities Explained

Understanding The R D Tax Credit 4 Part Test Pm Business Advisors

R D Tax Credit 4 Part Test No Surprise Quiz Here Tri Merit

Increased Interleukin 23 Receptor T Cells In Peripheral Blood Mononuclear Cells Of Patients With Systemic Lupus Erythematosus Topic Of Research Paper In Medical Engineering Download Scholarly Article Pdf And Read For Free

The Four Part Test R D Tax Credit Qualifying Activities Explained

Proactive Market Orientation And Business Model Innovation To Attain Superior New Smart Connected Products Performance Emerald Insight

The 4 Part Test To Qualify For The R D Tax Credit Portland Or Singlemind

Pdf The Adjuvants Polyphosphazene Pcep And A Combination Of Curdlan Plus Leptin Promote A Th17 Type Immune Response To An Intramuscular Vaccine In Mice

Digital Innovation Hubs Smart Specialisation Platform

R D Credit Four Part Test Explained Employer Services Insights

The Four Part Test R D Tax Credit Qualifying Activities Explained

Pdf Interleukin 17 Production Among Patients With American Cutaneous Leishmaniasis Daniela Faria Academia Edu

Disruptive Software Products Capgemini Engineering Next Core Lohika Capgemini Engineering

What Is The Four Part Test R D Qualification Texas Cpa Firm Calvetti Ferguson

R D Tax Credit The Four Part Test Forvis

R D Tax Credit 4 Part Test No Surprise Quiz Here Tri Merit